How to File Income Tax Return in Pakistan

How to File Income Tax Return in Pakistan

If you are an eligible taxpayer in Pakistan, you should know more about "How to File Income Tax Return in Pakistan". The Federal Board of Revenue (FBR) is the head institution for collecting and dealing with all the taxes paid inside Pakistan. All those citizens of Pakistan who are included in the Active Taxpayer List (ATL) by the Federal Board of Revenue (FBR) are required to pay their taxes with a sub-charge if they haven't paid their Tax Year-2020. We have all the details related to the method of filing tax returns in Pakistan.

How Income Tax is calculated in Pakistan

|

S. No. |

Income slabs |

Income tax rate (%) |

|

1 |

Up to Rs 2.5 lakh |

Nil |

|

2 |

Between Rs 2,50,001 and Rs 5 lakh |

5% |

|

3 |

Between Rs 5,00,001 and Rs 7.5 lakh |

10% |

|

4 |

Between Rs 7,50,001 and Rs 10 lakh |

15% |

|

5 |

Between Rs 10,00,001 and Rs 12.5 lakh |

20% |

|

6 |

Between Rs 12,50,001and Rs 15 lakh |

25% |

|

7 |

Above Rs 15 lakh |

30% |

Income tax returns for Tax History

|

S. No. |

Year |

Amount of Tax Filed |

|

1 |

2019 |

2.43 million as of Feb. 28, 2021 |

|

2 |

2020 |

2.62 million as of Feb. 28, 2021 |

Different Tax Payer Categories for the Sub-charged to be paid

|

Tax Payer Categories |

Surcharged to be paid for |

|

For companies |

PKR 20,000 |

|

Association of persons |

PKR 10,000 |

|

For individuals |

PKR 1000 |

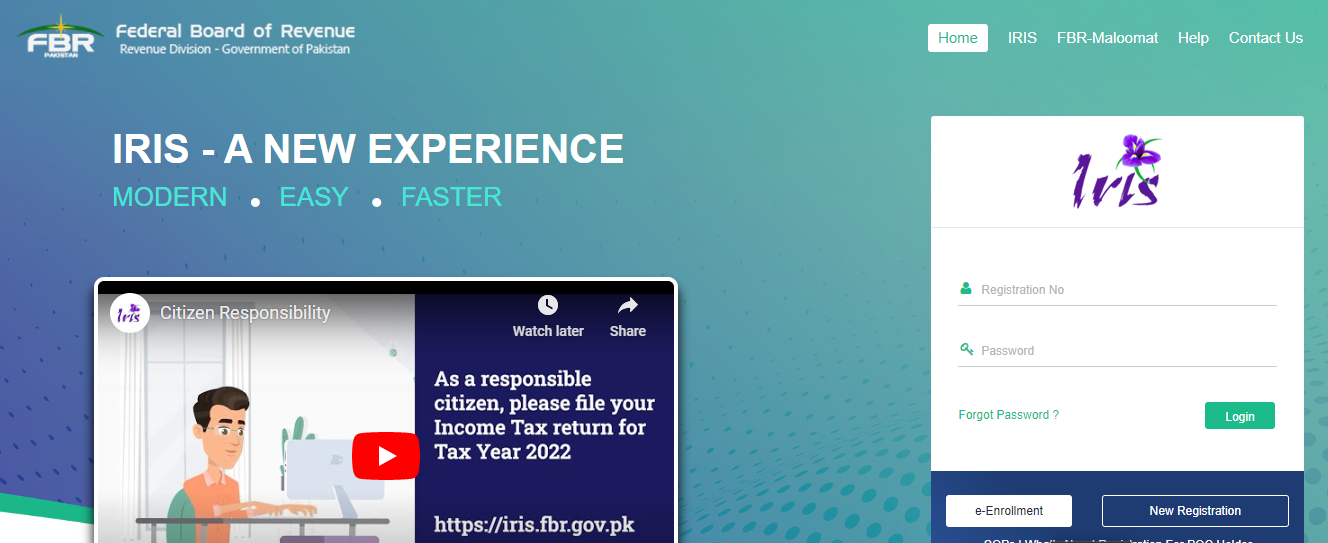

How to sign in to Iris Portal and process the File Income Tax Returns

-

Visit the Website at: fbr.gov.pk.

-

First, go to the Iris Portal set up for filling the income tax returns.

-

Enter your username and password. Log into the Iris Portal.

-

If you don't remember your password, click on forgot password it would send a recovery email to the one you are registered on the portal.

-

If you don't have an account, click on the signup button and register yourself on the portal.

-

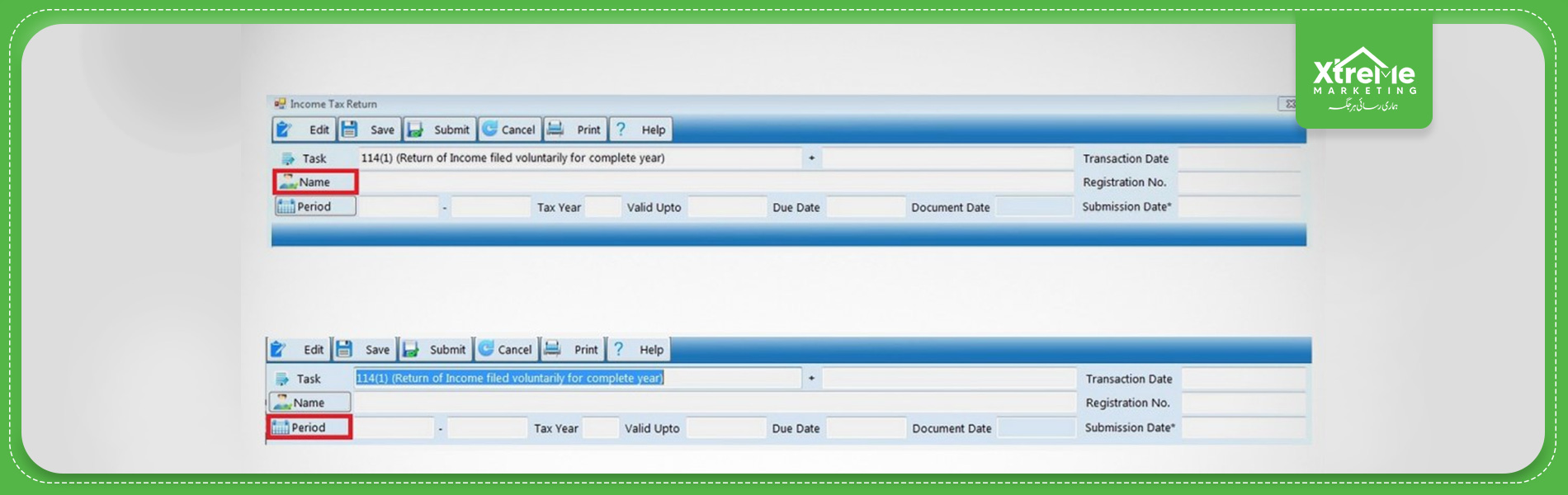

When you have signed in and logged into the Iris Portal, you would then click on the "Declaration" on the top inside the Menu bar.

-

Now click on the tab under the form which says, '114(1) Return of Income Filed Voluntarily for 1 Year'.

-

Click on the Period tab, which says the year you have to pay the taxes.

Employment Section

-

Now another Page would pop out where you would click on the Employment Section.

-

After going to the employment section, click on the "Salary Tab".

-

Enter your yearly or annual income using the salary received in the total amount tab.

-

Enter the amount/income excluded by the salary inside the following bar - "Amount Exempt from Tax".

-

After entering all the relevant data, click on the calculate button given on the page.

-

You provide the total tax amount exempted from the taxes and is subjected to the final tax input fields.

-

Again, click on the calculate button given on the page.

Adjustable Tax and the Amount of Tax Deducted

-

Select the Tax Chargeable/Payment’s tab and go to the Deductible Allowances tab there, amounts are deducted under the zakat, or charitable donations should be entered.

-

Enter all relevant tax amounts, tax reductions, adjustable taxes, and tax credits tabs.

-

By selecting the Adjustable Tax screen/tab, you would be required to enter the information of the taxes that have already been paid or taxed in the same year.

-

For all federal sector government employees, you must tax the amount against the 64020001 code.

-

For all provincial sector government employees, you have to tax the amount against the 64020002 code.

-

For all corporate sector government employees, you have to tax the amount against the 64020003 code.

-

You can also adjust the amount of tax deducted from your bank account on several sections while you withdraw cash/amount from your bank account in 64100101.

-

You have to tax the amount against the 64151501 code for all your bonds or savings.

-

You are also working on the adjustment of your taxes charges deducted etc., by your bank account on registration of motor vehicles, any transfer fees, sales, and leasing amount against any respective codes, etc.

-

You would see a dialogue box pop up that would ask for any vehicle details like that of "E&TD Registration Number" and add further details related to the vehicle like its engine capacity, model, make, etc. After adding all the relevant details, click on the calculate tab button.

Tax Chargeable/Payments

-

Click on the Payment Tab, and a detailed window will be opened related to the details of your income and chargeable taxes.

-

Review/Check the tabs related to the admitted Income taxes and demanded income taxes.

- Again, if you were able to identify any amount against the demanded income tax tab/section, then you will be required to pay the amount along with an attachment of the relevant CPR (Computerized Payment Receipt)

The Net Asset

-

Select the personal assets menu to enter your information related to Net Assets.

-

Now enter all your previous year's net assets and the current year's net assets.

-

Also, enter the total amount of total inflow of income and also outgoing channels of amount.

-

After entering all the relevant details, click on the calculate button.

-

You should always ensure that the 'Unreconciled Amount' remains zero when you enter all the information.

Payment for Demanded Tax

-

You have to submit all the details of your tax returns in the following manner once the Demanded Tax is paid either through the Alternative Delivery Channel (ADC) or via any authorized branch of the National Bank of Pakistan (NBP).

-

Go to the payment tab and select the + (Plus) sign given on the top right of the page.

-

Now, a dialogue box will pop up, asking for all the payment details/information.

-

You should now enter a valid CPR (Computerized Payment Receipt) number or the amount paid, after which you should select search options.

- You would see the entire list of details of your payment, then you should click on the OK button and save all the details.

How do verify income tax returns forms and submit them?

-

After entering all your information and data related to the income/assets, you should also verify your identity.

-

Your valid name, as well as your registration number, shall be provided and saved.

-

You should save the verification pin or code you received during the registration process and then click on the given verification pin tab.

-

You will be able to file your income tax returns on the submit tab, as you will be provided with the relevant details.

Projects By Xtremes Marketing

Blogs

- Urban City Lahore

- Damaan City Lahore

- Unveiling the Illegality

- NADRA's Online Portal for CNIC Verification in Pakistan

- Unlocking Agriculture in Pakistan: Types and Strategies

- Top 11 Real Estate Agencies in Karachi: Projects & Services

- Navigating Success: The Top Sales Agents and Property Dealers in Karachi, Pakistan

- List of Approved Housing Societies in Multan by MDA

- Citi Housing Kharian: A Serene Abode of Modern Living

- Approved Housing Societies In Peshawar Town - II

- Approved Housing Societies in Nowshera By TMA - Redefining Modern Living

- Bahria Town vs. Citi Housing Peshawar: A Comprehensive Comparison

- Bahria Town Peshawar

- Top 10 Restaurants in Swat to Delight Your Taste Buds

- Top 10 Places To Visit In Gilgit-Baltistan

- Calculate Zakat 2023 Guide

- Xtremes Marketing: Empowering Real Estate Business and Customers in Pakistan

- Trending List of Illegal Housing Societies in Lahore by LDA

- Kalam Valley Housing Scheme: Discover the Serene Living Experience

- Approved Housing Society In Mardan By TMA

- Delight City Mardan: Your Gateway to an Ideal Lifestyle

- Top 10 Schools In Peshawar

- Top 10 Apartments in Peshawar: Luxurious Living in the Heart of the City

- Discover the Authentic Flavors: Top 10 Best Restaurants in Peshawar

- Unleash Your Real Estate Superpowers: Elevating Your Customer Service Skills

- 10 Unconventional Pre-Listing Home Improvements That Buyers Can't Resist

- Vertical Cities in Pakistan: Advantages, Housing Solutions, and Future Prospects

- Red Alert - Notice Issued to Owners of Six Illegal Housing Societies in Rawalpindi

- Breaking News - FIR Lodged Against Illegal Housing Societies in Rawalpindi by RDA

- Countryside Residencia - New Location, Masterplan, & Payment Plan

- List of In-Process Housing Schemes by PHA in Khyber-Pakhtunkhwa (K-P)

- Rise in Demand for Flats in Karachi: A User-Friendly Guide

- Top Rated 17 Best Real Estate Investment Companies – Reliable & Professional

- A completed list of housing societies in Karachi scheme 45

- No Objection Certificate (NOC) in Real Estate

- 8 New Mega Projects by FGEHA Developers

- SBCA Illegal Properties List 2023

- LDA Approved Housing Schemes

- Blue World City (BWC)

- List of Registered Housing Societies in Karachi

- How to Register Real Estate Company in Pakistan

- How to Check Property Documents in Karachi

- Top 6 Mega Infrastructure Projects in Karachi

- Top 11 Real Estate Companies in Peshawar

Special Discount Offer