How to Register Real Estate Company in Pakistan

Table of Contents

How to Register Real Estate Company in Pakistan

Running a real estate company in Pakistan might be more challenging than it looks. Even before starting the on-ground operations, there are many things and procedures to look after. The government of Pakistan has an e-governance policy that presides across all departments and institutions. Businesses are bound to be registered and verified before starting a business in the region.The SECP (Security Exchange Commission of Pakistan) is responsible for evaluating, monitoring, and registering startups and other businesses. There is an e-portal provided to the users making it even more convenient to register and start a real estate company in Pakistan. While there are some businesses or startups which are required to present their business model for approval to the NIFT (National Institutional Facilitation Technologies (Pvt.) Limited) If you are an investor, entrepreneur, or owner of a real estate company, then you should continue reading How to Register Real Estate Company in Pakistan below:

1. Registration of Real Estate Company With SECP

1.1. Online Registration Method

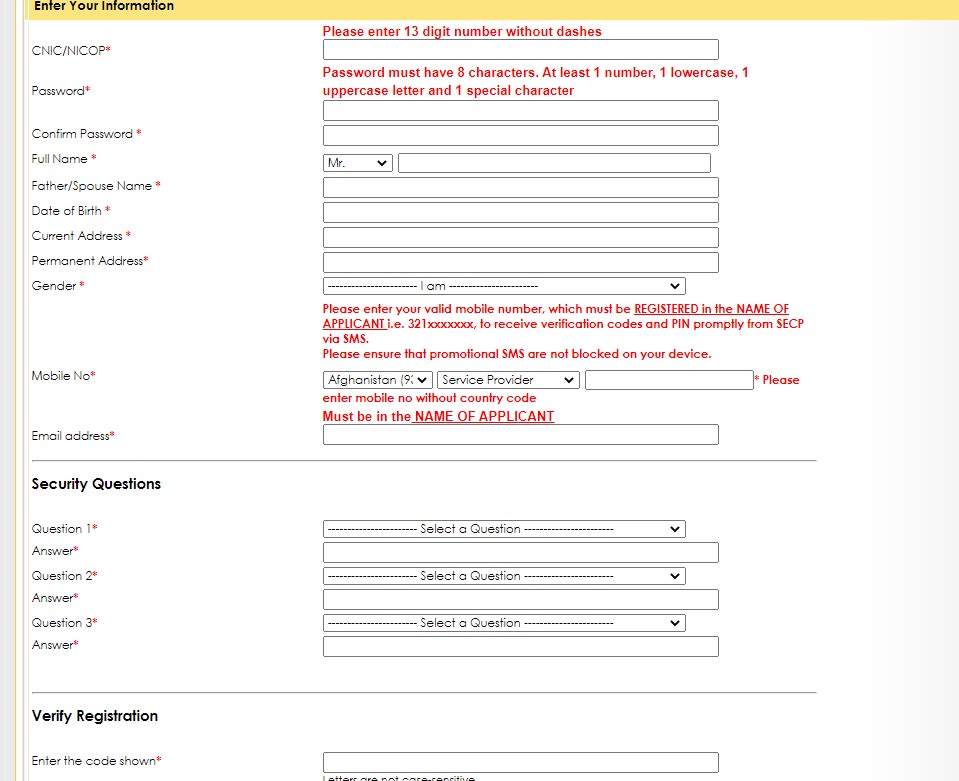

There is an online method of registration for real estate company with SECP, which is far easy and reliable, saving you time and money. SECP provides a user-friendly and professional e-portal registering your real estate company in Pakistan .

Following are the three different stages involved in company registration.

First Step

To start the registration process of your real estate company in Pakistan, you would need to follow the below initial steps:

1. Go to the website of SECP .

2. You will see register / sign-up, a form will be requested, and submit the registration form.

3. You would verify your submitted account on the SECP online portal.

4. Save all the credentials with yourself for logging in next time, i.e., CNIC or Passport Number.

Second Step

1. You would now submit the real estate company's details and documentation.

2. Click on the "Name Reservation and Company Incorporation."

3. Now, as per your choice, enter three given names for the real estate company in Pakistan. The proposed names should be relevant and partial as per your industry.

4. You will be requested to provide details related to your business, its specific type, and the overall structure of the corporation.

Third Step

In the final step of the registration process, you will submit the following details:

· Location

· Total Members

· Contact Information

· Total Capital

After completing the registration process and submitting all the details, you will now wait for the review.

1.2. By Hand Registeration Method

Instead of doing things online, you can also opt for the in-person or physical presence of company registration. But, registration of the company online in Pakistan will benefit you, while the in-person process will cost you more fees and time. The official authorities also appreciate the online registration of the real estate company in Pakistan.

- You must download the application or registration form from the SECP website.

- After filling out the registration form downloaded from the e-portal, go to the nearby registrar and submit it. You can locate the address of all government offices on the official website.

- Once your application is reviewed and found eligible for further evaluation, you will be issued an availability letter valid for two months only. The overall process will take about sixty days or two months.

Required Documents for Submission to SECP

Once your registration form gets approved by the official authorities, you will be requested to submit documents in pdf form on an e-portal. The Memorandum of Association will have overall authentic details about your company. An Article of Association: This file details the board of directors and their respective duties in the company.

· A list of all the Directors' CNIC

· A paid Bank Fee Receipt

· Payment of Registration or simply Registration Fee

Fees and Capital Limitations for Company Registration with SECP

According to the type and size of the corporation, there are different fees and capital limitations in Pakistan.

· There is a need for a capital amount of at least Rs—100,000 Pakistani Rupees to register any startup or corporation in Pakistan.

· A non-refundable fee of Rs. 1800 on the e-portal submission, and if you do it in-person submission/manually, there is an Rs.3500 registration fee.

2. Online Registration of Real Estate Company with FBR

To keep things smooth and transparent enough, the government of Pakistan has made it essential for all to register with FBR (Federal Board of Revenue). Any Pakistan business or real estate company must register with the FBR (Federal Board of Revenue).

Documents required for Submission to FBR

To register your real estate company in Pakistan with the FBR (Federal Board of Revenue), you will need to submit the following documents:

1. The NTN (National Tax Number)

2. A Proof of your Company's Registration with SECP

3. You’re Company Bank Account Information

4. Both copies of the company Article and Memorandum Association

5. Actual Business Address

6. Also, CNIC Copies of all listed company directors

Registration for Sales Tax in Pakistan with FBR

Any company that has obtained an official STN (Sales Tax Number) can register for Sales Tax in Pakistan.

How to Register For Sales Tax With FBR

Here is the procedure for processing the sales tax registration with FBR:

- Go to the IRIS Portal at - https://iris.fbr.gov.pk/public/txplogin.xhtml.

- Login if you are already registered, or Sign up if you haven't registered yet on the portal

- Once signed up, click on login and insert your IRIS Portal Registration Number/CNIC Number/NICOP Number in the Registration No. Field.

- Enter your Password in the given sign-in window.

- After entering all the credentials, click on the login button.

- It would lead you to verification of your request on the IRIS Portal, which would redirect you to the IRIS Dashboard.

Step Wise Guideline for Sales Tax Registeration with FBR

- Once users are logged into the IRIS Portal, users will be redirected to a new IRIS Dashboard.

- Go to the Registration Tab on the Main Menu. A drop-down list will appear, which will show two options.

- Now, click on the first one named as - (14(1) Form of registration field voluntarily through Simplified) (Sales Tax).

- Users will now click on the given calendar icon, which can be visible on the period field; this will Load the tax period search window.

- Users should know that "Sales Tax Registration" is available for the current tax year and onwards. Users should enter the current tax year in the "Tax Period" tab and click on the search button/icon. Users will see the load Tax Period as shown:

- You will now click on the button titled "Select," given in front of the tax period below the action Column. Users will be redirected to the "Sales Tax Registration Task" window. It will automatically load the "Information" tab with the Registration No., email, or cell number auto-filled in respective fields as per the FBR records.

- Suppose users signed in are unable to change the Registration No. Or email or related cell phone No. In another case, if the account belongs to a specific firm/institute or company, the users can enter the "CNIC of Member/Director/Principal Officer" in the given dashboard.

- In the case of an enterprise or institute, the verification of the CNIC should be acknowledged once the user enters it and the code is sent to the registered mobile. After receiving the SMS code on the registered mobile, please enter it in the given tab and click on verify.

- Users will now select the "Type" option given on the radio options given as manufacturer and non-manufacturer. Selection of the "Type" is mandatory for all enterprises and companies.

- Now, users will be clicked on the "Bank Account" option, which is given on the task window; the application window will redirect to the "Load Bank Account Information Details Form." Users must click on the "+" sign while entering the required information button at the right-most column in the popped-up form, as shown.

- Users will be directed to a dialog window requesting to enter the bank information to proceed further.

- After entering the bank information, users are required to click on the "Ok" button. Users can now enter accounts by repeating the above process, as explained. At the same time, the primary account should be marked by selecting the "Primary Account Check" given in the respective bank account information.

- Once users add the business details, click on the "Business" tab given in the task window. Users should click on the rightmost column of the form.

- You should now click on the "Add Business" window and enter the following details: 1. Business Name, 2. Business Acquisition Date, and 3. Select Capacity from the drop-down list given on the window.

- Users can now "Add Business Activity" by selecting the "+" button. The "+" button is on the right column below the activities section. The system will load the business activities dialog itself.

- Now, users will be requested to enter the business activity details and select the "OK" option for adding the business activity history. Any taxpayer can enter the details related to multiple business activity histories or records by following the above process. Users need to focus on two things, 1. Enabling the Check to Mark Principle Activity, and 2. ST Option while adding record or history as shown.

- Users will now add the required activities details and click on the "OK" Option. You can add several other business activity records to the account, but users must register at least o single business for sales tax.

- After users successfully add the business record, users can edit the given information by going to the editing option.

- Users should click on the "Edit" icon to make changes to their business information, and the system will load the entered details in the "edit mode" given on the window titled business details.

- Users should now click on the "+" if they want to link property information/ businesses/company branch addresses to the highlighted business record.

- When you click on the "Add Other Property" option, it enables you to add new property details. Users can enter the details in the "Property Window" if they want to search for a property.

- If users want to "Add or edit" the property records, they should click on the "Property" tab. A new window will pop up where users can add property details or records by selecting the "+" button at the rightmost column.

- Users can now add their property records on the given form and click on the "Button" to save the property information.

- Users can now see the property records added under the "Business Properties" section. Users can now delete or remove the link with a single click on the delete button icon, which is given in front of the property record under the business properties grid.

- Once the user adds all the business details, now you can add the utility connections details by going to the "Utility" tab of the task window.

- Users can select the local business address history below the "Utility Tab." If you want to open the "Utility Tab," you should click on the "+" button.

- You can now add relevant "Utility Connections" details in the provided window and select "Ok" to save the record.

- Users should repeat all the specified steps to add relevant utility connections for the specified property or business address.

- To add the relevant documents, users should click on the "Attachments" tab, which will complete the sales registration process for the business or property.

- Users should select the "+" button below the "Action" column against the attached document details to upload the relevant images.

- After completing all the relevant steps and attaching the documents and images, users should review the details.

- After a brief review, click on the "Save" button.

- Now, users can click on the "Submit" button, which will wrap up this process. (After clicking the submission, users can no longer edit the data)

- Users can initiate the sales tax payment request as soon as they submit the sales tax registration form. However, they would still need to verify the process through biometric verification, which makes them eligible to file a sales tax return.

How to Bio-Meteric Verification For Sales Tax Registeration with FBR

- To process the bio-metric verification for the Registration of sales tax. The applicant of the sales tax registration is required to visit in-person to the e-Sahulat Center of NADRA within one month, counting from the date of Registration for the bio-metric verification.

- Once the NADRA office approves the bio-metric verification for the sales tax, the applicant will be eligible to file the Sales Tax Returns.

- In another case, if the applicant does not visit the NADRA office for the bio-metric verification for Registration of sales tax, then they will be removed from the given list of Active Taxpayers.

Physical Verifcation for Sales Tax Registeration

- For such users who are manufacturers themselves, the above Registration for sales tax would take place only after the Registration of their business or company.

- In either case of manufacturers or non-manufacturers, only authorized tax officers will be eligible to allow for initiation of the formal request for the taxpayer.

- At the same time, it can also help the applicant guide the process and document submissions, etc., within 15 days.

- If the applicant fails to follow the guidelines above, they will no longer be a part of the Active Taxpayer List in Pakistan.

What if an Error occur in the Sales Tax Registeration Process?

Applicants or Users who face trouble accessing the IRIS Portal or find it unable to work on it due to internet issues. They should re-login into the IRIS Portal once the internet connection is restored and resume their process.

Documents required for Submission to Sales Tax to FBR

There are some documents and essential information requested by the official authorities to get register for the Sales Tax in Pakistan, given below:

1. Details of the Board of Directors (Two Minimum)

2. You will be requested to provide details of any two shareholders

3. A minimum capital amount of at least Rs. 100,000 Pakistani Rupees

4. Facts about the Office location or address of the business

Benefits of Company Registration

Why should you register your business in Pakistan? Below are some highlighted benefits that can acquire from the company's registration in Pakistan.

· Verified and Legal Business

· Growth of Business

· Perks and opportunities available to Registered Companies

· Visibility in a Competitive Marketplace

· Recognition in the Real Estate Industry

FAQs

Question: How to register a real estate company in Pakistan?

Answer: You need to visit the website of SECP (Security Exchange Commission of Pakistan) and follow the above procedure in the detailed form.

Question: What's the role of SECP in business registration?

Answer: SECP (Security Exchange Commission of Pakistan) is the institution responsible for evaluating, monitoring, and registration of companies.

Question: Why is it essential to get register with FBR?

Answer: Any business or real estate company must register with the FBR (Federal Board of Revenue) to work in Pakistan.

Question: Is it free to register a company in Pakistan?

Answer: No, a non-refundable fee of Rs. 1800 for the e-portal submission.

Question: Importance of Real Estate Agency Registration in Pakistan?

Answer: Real estate agency registration in Pakistan is processed by the SECP and FBR both are state departments.

Question: Real Estate License in Pakistan?

Answer: In order to get your real estate license in Pakistan you are required to get register with both the SECP and FBR.

Question: Property Dealer Registration Form?

Answer: In order to get a license or permit of work, each authority or housing scheme issues different property dealer registration form.

Question: FBR Property Dealer Registration in Pakistan?

Answer: You should go to official website of FBR where you can obtain the authentic details about the FBR Property Dealer Registration in Pakistan.

Question: Real Estate Agent License in Pakistan?

Answer: Real estate agent license in Pakistan is obtained in a simpler manner. But, each of the authorities offers different levels of Real Estate Agent License.

Projects By Xtremes Marketing

Blogs

- Urban City Lahore

- Damaan City Lahore

- Unveiling the Illegality

- NADRA's Online Portal for CNIC Verification in Pakistan

- Unlocking Agriculture in Pakistan: Types and Strategies

- Top 11 Real Estate Agencies in Karachi: Projects & Services

- Navigating Success: The Top Sales Agents and Property Dealers in Karachi, Pakistan

- List of Approved Housing Societies in Multan by MDA

- Citi Housing Kharian: A Serene Abode of Modern Living

- Approved Housing Societies In Peshawar Town - II

- Approved Housing Societies in Nowshera By TMA - Redefining Modern Living

- Bahria Town vs. Citi Housing Peshawar: A Comprehensive Comparison

- Bahria Town Peshawar

- Top 10 Restaurants in Swat to Delight Your Taste Buds

- Top 10 Places To Visit In Gilgit-Baltistan

- Calculate Zakat 2023 Guide

- Xtremes Marketing: Empowering Real Estate Business and Customers in Pakistan

- Trending List of Illegal Housing Societies in Lahore by LDA

- Kalam Valley Housing Scheme: Discover the Serene Living Experience

- Approved Housing Society In Mardan By TMA

- Delight City Mardan: Your Gateway to an Ideal Lifestyle

- Top 10 Schools In Peshawar

- Top 10 Apartments in Peshawar: Luxurious Living in the Heart of the City

- Discover the Authentic Flavors: Top 10 Best Restaurants in Peshawar

- Unleash Your Real Estate Superpowers: Elevating Your Customer Service Skills

- 10 Unconventional Pre-Listing Home Improvements That Buyers Can't Resist

- Vertical Cities in Pakistan: Advantages, Housing Solutions, and Future Prospects

- Red Alert - Notice Issued to Owners of Six Illegal Housing Societies in Rawalpindi

- Breaking News - FIR Lodged Against Illegal Housing Societies in Rawalpindi by RDA

- Countryside Residencia - New Location, Masterplan, & Payment Plan

- List of In-Process Housing Schemes by PHA in Khyber-Pakhtunkhwa (K-P)

- Rise in Demand for Flats in Karachi: A User-Friendly Guide

- Top Rated 17 Best Real Estate Investment Companies – Reliable & Professional

- A completed list of housing societies in Karachi scheme 45

- No Objection Certificate (NOC) in Real Estate

- 8 New Mega Projects by FGEHA Developers

- SBCA Illegal Properties List 2023

- LDA Approved Housing Schemes

- Blue World City (BWC)

- List of Registered Housing Societies in Karachi

- How to Register Real Estate Company in Pakistan

- How to Check Property Documents in Karachi

- Top 6 Mega Infrastructure Projects in Karachi

- Top 11 Real Estate Companies in Peshawar

Special Discount Offer